Share this

What is Category Management? 5 Tools for Success

by Surefront on Apr 25, 2024 10:30:00 AM

Home > Blog > What is Category Management? 5 Tools for Success

Table of Contents

- What is category management?

- An example of category management

- 8 steps to implement category management

- Why category management was created

- How category management has evolved

- The four Ps of category management

- The five best tools for a category manager

- The new wave of category strategies

Category management gathers similar products into a single category to address business initiatives for that particular product set. Category management optimizes how your retail team accesses products, maintains buyer/supplier relationships, and executes the procurement process.

Do you want to efficiently source products and increase margins? That's the main objective of category management tools. They aid in sourcing while providing repeatable processes for internal and external communication.

In this article, we’ll give you a breakdown of category management. We’ll also share 5 category management tools for improving your merchandising process.

What is the category management process?

First, what’s a “Category”? A category is any group of similar items that a company wants to buy under the umbrella of a single deal.

“Category Management” is about making business decisions at a category level. These initiatives can include the procurement process, product information management, merchandising, sales, product lifecycle management, and other retail efforts.

It’s important to differentiate between category management and similar concepts:

- Category management. The process of grouping similar items into categories to address larger business concerns.

- Vendor management. The managing of product communication and collaboration to bring new products to market.

- Product data management system. A piece of software that manages data but may or may not have category management tools.

- Catalog management. The process of building and maintaining your online catalog of products.

Now we know what category management isn't, let's talk about what it is. At its most basic level, category management bundles like items to avoid separate or scattered agreements. This saves time, money, and resources by consolidating disparate agreements into a single contract. Category management is a quintessential feature of your overarching product collaboration strategy.

A practical example of category management

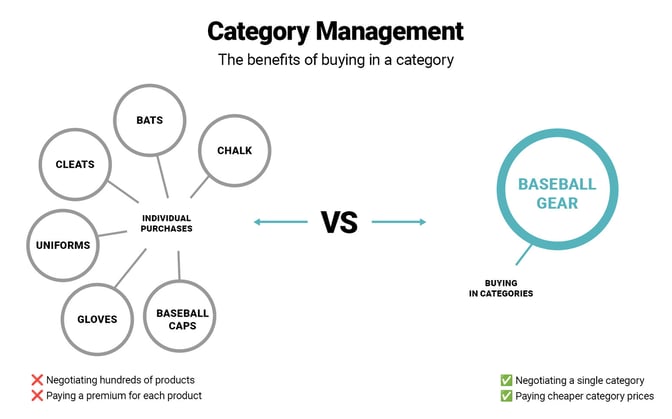

Let’s say you’re a sporting goods retailer looking to bolster sales ahead of Little League season. You have a procurement team dedicated to your baseball department ready to source products.

Without category management, your buyers will end up negotiating one-off agreements. Suppliers can take advantage of your urgent need to source baseball equipment, which drives up per-unit pricing. This isn't the ideal situation.

It’s inefficient to have separate buyers negotiating single contracts for bats, gloves, balls, protective equipment, and soft goods. Especially when you can when you can negotiate them together.

By bundling goods into one category and agreeing on a single contract, you can better track negotiations with built-in risk management. You can manage category negotiations, assess category performance, and drive down pricing. You can also cut the time and resources needed to negotiate agreements when a single order contains more units.

The result? Category insights drive better supplier relationships, a more profitable product mix, and transaction-building category tactics. You’ll have a better product selection, boosting your brand image and increasing customer loyalty.

8 steps to implement and maintain category management

Category management was coined by Brain F. Harris in 1997. The methodology was intended to improve the strategic approach to sourcing. Harris’s project management approach is structured, and measurable. It has a track record of driving improvements across an organization’s processes.

Harris suggests you use the following 8-Step Cycle to implement and maintain category management:

- Step 1: Define the Category – Set the parameters for your category based on your customers’ behavior. How do they navigate the category? This will help inform product selection and category segmentation.

- Step 2: Assess the Category Role – Assess how the category relates to your broader portfolio. Define the category's role in your current strategy and its importance and impact. Approach this step from a sales perspective and a volume standpoint.

- Step 3: Track Performance – Assess how the category is performing from different angles. How does it perform at the retailer, within the market, compared to other categories, etc? This multi-lensed approach will provide a foundation for the next few steps.

- Step 4: Set Benchmarks and Objectives – Any business initiative should have clear goals for driving success. Your merchandising plan is no exception. Define your benchmarks and objectives to set the category’s KPIs. Asses sales, volume, market share, and assortment to ascertain overall profitability.

- Step 5: Plan Strategies – Gather your thought leaders and devise strategies built from your goals. Devise a marketing angle and in-store presence for your category. Always look for ways to grow market share, increase sales, and boost foot traffic.

- Step 6: Designate Category Tactics – Get into the nuts and bolts of putting your strategies into motion. Set clear and repeatable actions to improve category strategies. Consider how to improve products, placement, promotions, and supply methods.

- Step 7: Implementation – Once you’ve set your strategies and identified your tactics, you’ll want a tangible plan for your team. Create a written plan to solidify tactics, category roles, and objectives.

- Step 8: Review – This isn’t a one-time procedure. It’s designed to be an iterative cycle. In this final step, measure your results and modify the process as you go back through the steps.

Why Was Category Management Created?

Before category management, the way buyers and sellers at most organizations collaborated to produce a product was chaotic and prone to delays, waste, and suboptimal output. Consider the above mentioned sporting goods example—when you give suppliers the power to set prices for individual products, your margins diminish.

That’s why Brian Harris created category management to address the following seven key areas:

- Force consumer focus when making retail decisions. Think of product signs at department stores. They give insight into category management hierarchy. These should be strategically placed and organized for the average consumer.

- Develop a strategy for differentiation and competition. The better organized your categories are, the more you can control your price when sourcing.

- Provide a model for collaboration. Organizing by category will inform your team on how to collaborate internally and externally with suppliers. Learn more about how your team can engage 3rd party partners in our supplier management article.

- Promote information sharing to improve decision-making. Information should be open and accessible for all involved across the category.

- Provide greater strategic logic when making tactical decisions. It’s easier to adjust or even pivot your different strategies for a category once all agreement info and current performance data are available in one place.

- Clarify decisions about asset and resource allocation. Think of category management as another arena for data analysis. Optimize the time and personnel you’ll need to complete all objectives for the product categories.

- Further clarify employee responsibilities. After organizing your procurement plan into categories, you can easily group personnel into those categories and better define their roles to achieve your goals.

A category plan will guard your organization against chaos. It’s a common language for buyers and sellers with designated inputs and outputs. This leads to predictable and manageable results.

How Has Category Management Evolved?

To better understand the value of category management, it’s important to look at where it came from. You may be familiar with strategic sourcing. Though the two have similarities, category management evolved from strategic sourcing.

The Brian Harris model refined the process of strategic sourcing by finding its weak points in organization and communication.

Typically, an organization’s buying team functions as the gatekeeper for suppliers. Their preferred procurement method is a Request for Quote (RFQ) to compare suppliers and their products/services. In the silo model, these RFQs are often created on an individual basis—to fulfill an immediate need. This neglects the bigger picture of related products.

Aside from working with suppliers, the buying team has direct relationships with legal, finance, and other key departments. They also engage with business reps—often in an ad-hoc or project-specific way. Suppliers communicate with these same stakeholders—usually without the buyers being present or aware. You can see where this model leaves gaps in communication and efficiency.

Category management breaks this siloed thinking. When you designate categories and the teams responsible for necessary functions, you maximize cost savings and efficiency with a clear and defined common goal. This process includes an open discussion by all stakeholders to optimize and streamline the supply chain for a given product category.

It’s time to start thinking about your organization from a category standpoint. By clearly defining these categories and following the 8-Step Cycle detailed earlier, you can begin to improve your workflow and increase profits.

Ask yourself the following to get started:

- How can I group and organize my similar products into defined categories?

- How would I organize my categories into a hierarchical structure? Do I have product segments that are more important than others? How do I define their importance?

- What are the steps for my team to go from the RFQ process to finalizing a purchase order? How is information shared between organizations? What steps (if any) are redundant?

- If product information management and product lifecycle management is part of your process, how does that fit into the questions above?

- What other internal departments do my buyers deal with to finalize a purchasing agreement? Do my suppliers have separate conversations with these departments?

Answering these questions should help you identify which processes you can adjust to implement the category management model.

The 4 Ps of Category Management

If you’re familiar with the core principles of product marketing, this will sound familiar. Great category management strategies are built upon 4 essential elements of successful products. These make up “the 4 Ps of effective category management,” which include:

- Product

- Pricing

- Placement

- Promotion

We'll now examine the role each of these Ps plays in category management.

#1 - Product

The category management function starts with the strategic procurement of goods. Every category manager must buy products to stock shelves, but product buying shouldn’t be random. It should be about bringing in the right products, at the right price, at the right time.

Category managers use previous sales reports, consumer trends, and seasonal forecasting to inform their buying decisions. This should be part of your unified PLM and PIM strategy.

Let’s dive into an example:

- A category manager for a clothing retailer wants to obtain affordable bottoms ahead of next season. Specifically, they want to get a pair of wool trousers from a supplier that has historically sold well.

- Market research and feedback suggest that demand for these trousers is high among working adults aged 30-45. The supplier is offering them at a great wholesale price, so everything points toward a win for the category manager.

- The only trouble is Spring and Summer are ahead and procurement is focused on outfitting the store for those seasons. Though the wool trousers are ideal for business people in Fall/Winter, they are not a good fit for the warmer seasons.

This underscores the power of category management to utilize financial and consumer trend data points to line up with seasonal buying. Category management is a dynamic, timely process that demands careful planning for the best product assortments. But it doesn't work alone.

For the best results, integrate your category management strategy into your overarching supply chain strategy, which should include: product lifecycle management, product information management, and customer relationship management.

#2 - Pricing

This one is fairly straightforward. When category managers buy products, they leverage wholesale quantities to drive down pricing. They also purchase for the category as a whole to get better per-unit pricing—as demonstrated in our sporting goods example.

Category managers also shop around from different suppliers to compare products and prices for their category plans. There are 2 price points to consider here: wholesale pricing and retail pricing.

Wholesale price is the business-to-business (B2B) price of the products. Then, there’s the retail price which represents the price tag for the shopper, or business-to-consumer (B2C). Retail price is informed by the purchase price and all other costs (shipping + logistics), or "landed cost," along with the target margin for the retailer.

Products come with a manufacturer’s suggested retail price (MSRP), which is another data point that helps a retailer set prices. To stay competitive, retailers must consider their margin compared to competitor pricing for similar products. Learn how to identify hidden revenue within your supply chain here.

#3 - Placement

This is where we get into planogram software. Category managers have to collaborate with merchandising teams to discover the best way to organize their assortments into cohesive categories within the store.

A good category management system keeps track of these assortments and considers the strategic placement of complementary products for logical continuity within the aisle. This is intended to bolster sales.

For example, the baking aisle at the grocery store will group flour, powdered sugar, cake mixes, oils, and baking soda all in the same general area. This helps with the customer experience and boosts sales. Placing ingredients for common baked goods in the same place helps customers remember the items they need and possibly stock up on even more than they need.

Retailers often place new items and specialty items on end caps and other visible displays. A healthy category management process connects assortment planning with merchandising teams to maintain and update the best planograms for business. Communication is key. The right Unified Product Collaboration Platform will open the lines of communication between internal and external associates for the best possible results.

#4 - Promotion

Retail promotions are marketing tactics used to drive sales. These promotions are usually timed before products hit shelves and during seasonal buying periods. Most retail promotions appeal to logic and urgency to ignite a need to purchase the product.

Many factors go into sales promotions, including inventory, seasonal relevance, sales performance, and competitor promotions. The category management team has to forecast the performance of their category, identify opportunities for promotions, and adjust the plan accordingly based on product performance. For more promotional insights, click here to read our latest piece on fashion retail marketing trends.

The 5 best tools for a category manager

It’s time to identify the best tools to accomplish your goals. We suggest both an all-in-one solution and some a-la-carte tools you can add to your daily operations.

1. Surefront Unified Collaboration Management Software

First, we’ll start with an end-to-end solution for your merchandising needs. Surefront provides industry-defining software that helps automate the category management process.

The live catalog offers easy-to-use tools for importing and categorizing your SKUs. Once you import your products, you can upload photos, and add specifications and pricing details for both internal and external use.

As a retail business or brand, these features help establish category management while streamlining merchandising and procurement processes. Surefront lets you create an internal structure for your teams and enables collaboration with outside organizations, all in one place.

This software eliminates the need to email spreadsheets, PDFs, RFQs, notes, and purchase orders to outside entities. Surefront brings these functions to one platform, improving productivity, eliminating waste, and increasing profitability. Sounds pretty similar to the goals of category management, right?

Surefront goes far beyond just category management software. We can help brands with their product lifecycle management and overall merchandising processes to achieve a guaranteed 10x ROI.

2. Assortment Optimization Software

When sourcing for brick-and-mortar retail, the products available at stores are important for the shopping experience. With assortment optimization software, you can take your category and inventory management up to a more focused level. Identifying customer segments along with the products that best serve those segments is crucial.

Retailers have moved toward offering assortments that align with local shopper preferences and values.

3. Planogram Software

Both retailers and suppliers use planograms to show how products should be displayed. This helps with determining how much space they should be allocated. Planogram software goes nicely with your assortment optimization. As you identify the products for your target segments, you can think about how your consumer encounters those products on the shelves or in the aisles.

Drawing a logical link between products in physical space increases sales. Think of chips and salsa being displayed next to each other. The logical link between the two promotes a single customer purchasing both even though one is a snack and the other is a sauce.

Planogram software helps with planning these logical connections and tactical displays.

4. Promotion Planning Software

Promotion planning software is connected to the space planning tools above. Top retailers use store promotion planning to improve supplier involvement and in-store promotions. This helps you create a strategic plan for different categories to earn additional revenue from suppliers.

From a category perspective, this can help you better align your procurement methods with your promotional plans to squeeze the best margins out of your products.

5. Retail Analytics Software

Knowledge is king. With retail analytics software, you can get an idea of how your categories and product segments are performing at the store level. This is what elevates the top retailers as they use data to understand consumer trends and needs.

The more you can connect multiple data sources for your categories, the better you’ll be able to merchandise like a pro.

The new wave of category strategies

You don’t want your data to be siloed. Your company’s CRM, PIM and PLM solutions shouldn’t operate in a vacuum, either. Surefront is a unified product collaboration platform to power growth and ROI. Our patented PIM, CRM, and PLM solutions streamline the omni channel sales, merchandising and product development processes. By combining these essential functionalities, Surefront creates a single source of truth throughout your product lifecycle, sales and listing processes.

Share this

- PLM Software (36)

- PIM Software (29)

- Apparel & Fashion (20)

- Trending Topics (20)

- Merchandising (16)

- CRM Software (13)

- PLM Implementation (11)

- Catalog Management (6)

- Tech Packs (6)

- PLM RFP (5)

- Success Stories (5)

- Sustainability (5)

- Data Import (4)

- Line Sheet (4)

- Luxury Goods & Jewelry (4)

- Product Development (4)

- Retail (4)

- Supply Chain (4)

- Category Management (3)

- Home Furnishings (3)

- Wholesale (3)

- Consumer Packaged Goods (CPG) (2)

- Cosmetics (2)

- Data Export (2)

- Health & Beauty (2)

- RFQ & Quote Management (2)

- Consumer Electronics (1)

- Import & Export (1)

- Industry Events (1)

- Inventory Management (1)

- Pet Stores (1)

- Purchase Orders (1)

- Report Builder (1)

- Textiles & Raw Materials (1)

- Unified Solution (1)

- Vendor Management (1)

- Visual First (1)

- White Paper or Case Study (1)

- workflow (1)

- October 2025 (3)

- September 2025 (3)

- August 2025 (4)

- April 2025 (4)

- March 2025 (3)

- January 2025 (8)

- December 2024 (5)

- November 2024 (3)

- October 2024 (5)

- September 2024 (6)

- August 2024 (2)

- July 2024 (1)

- June 2024 (3)

- May 2024 (4)

- April 2024 (5)

- March 2024 (3)

- February 2024 (2)

- December 2023 (4)

- September 2023 (2)

- August 2023 (5)

- July 2023 (3)

- June 2023 (2)

- May 2023 (2)

- April 2023 (4)

- March 2023 (5)

- February 2023 (3)

- January 2023 (5)

- December 2022 (4)

- November 2022 (3)

- October 2022 (4)

- September 2022 (5)

- August 2022 (4)

- July 2022 (2)

- May 2022 (1)

- February 2022 (1)

- January 2022 (1)

- September 2021 (1)

- May 2021 (1)

- April 2021 (1)

- February 2021 (1)

- May 2020 (1)