Share this

The ROI of Happy Retail Employees

by Surefront on Apr 20, 2023 11:13:36 AM

Home > Blog > The ROI of Happy Retail Employees

Table of Contents

- What is the employee retention rate in retail?

- Toxic workplaces are the unspoken obstacle

- What is the ROI on employee retention?

- Why do retail employees leave their jobs?

- Good news for your return on investment

- How unified PIM & CRM help employee retention

The employee retention rate in retail is unprecedentedly low. The “quit rate” in US retail and hospitality are the highest of any industry, outpacing that of the US as a whole by over 70 percent. But retail teams don’t just need to factor in the cost of losing a frontline retail employee. Retail managers are quitting at almost the same rate.

McKinsey calls this phenomenon “The Great Attrition.” This can also be defined as the gradual reduction of the U.S workforce due to employers being unable or unwilling to meet employee expectations –– particularly in a post COVID landscape, where employees are more aware of their own priorities, while increased awareness of their own mortality makes employees less willing to waste time in positions that don’t reflect those priorities. (We’ll go into what those priorities are in a moment.)

This brings to mind the question: how can retailers provide customers with an outstanding shopping experience when they’re losing 60% or more of their employees each year? Most can’t. Hence why it’s essential to have an understanding of why retail employees become dissatisfied and which measures to put in place to retain them. But let’s kick it off with some cold, hard facts –– starting with the employee retention rate in retail.

What is the employee retention rate in retail?

The U.S. Bureau of Labor Statistics reports that the average retail employee turnover rate in 2023 is currently about 60%. A “good” retention rate is considered 80% or higher. Part-time and hourly frontline employees have the highest turnover rate at 76%. The C-suite has the lowest rate of employee turnover in retail, at around 17%. And mid-level employees? Well, McKinsey reports that 63 percent of frontline retail managers are considering quitting in the near future.

It’s nearly impossible to create a workplace environment that team members can get behind when most branch managers are thinking about jumping ship. An environment of disengaged team members can lead even the most dedicated employee to resign themselves to silent quitting. But, all too often, retailers make the mistake of chalking up massive employee turnover to being due to the state of the industry, rather than a major obstacle to profitability that needs to be addressed posthaste.

Toxic workplaces are the unspoken obstacle

Mckinsey found that over 60 percent of negative workplace outcomes are due to toxic workplace behavior. Toxic workplace behavior has, for years, ranked #1 on the list of factors that steer teams towards negative outcomes, including “intent to leave” as well as mental health struggles like burnout, depression, and anxiety. No employer hopes to go through the rigorous process of selecting a new hire just for them to realize that the culture is toxic and/or unsustainable.

Job board sites like Indeed and Glassdoor give employees the opportunity to review their past workplaces in detail. As such, toxic workplaces don’t just cause obstacles to profitability and retention, they also pose obstacles to recruiting future talent to fill vacant roles. But don’t get discouraged. A recent poll by The Muse found that respondents most often identified “leadership and management training” (43%) as a step that could’ve improved their toxic workplace. This was followed by accountability for team members (33%) and better working conditions (26%).

What is the ROI on employee retention?

So, what’s the ROI on employee retention? It depends on the level of the employee. As you may suspect, skilled workers require more resources to train than frontline talent. However, here’s a good average to go by:

The cost of losing an entry level/frontline employee: 30-50% of that employee’s annual salary.

The cost of losing a mid level employee/middle manager: 150% of that employee’s annual salary.

The cost of losing a senior/C-suite/specialized employee: 400% of that employee’s annual salary.

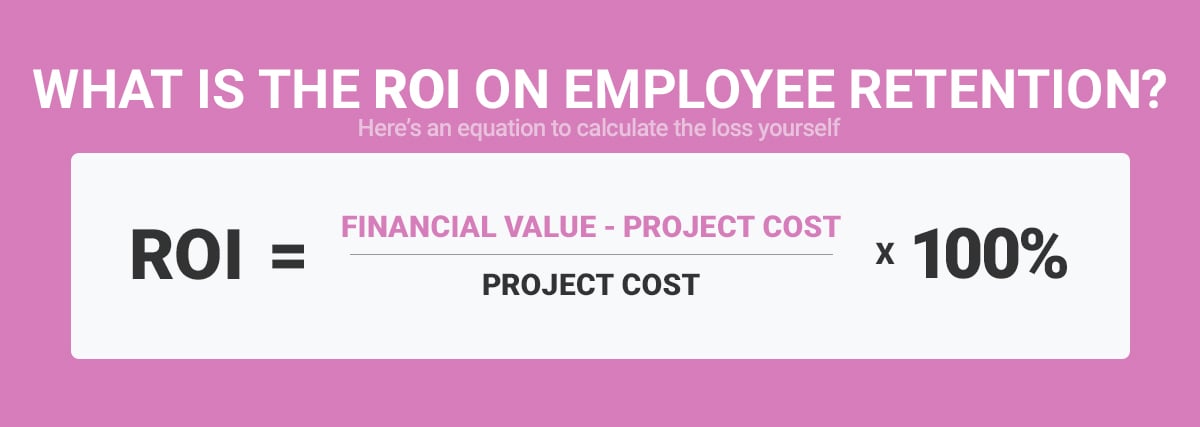

Here’s an equation to calculate the loss yourself:

Say Company X is a retail startup with 100 employees. Company X loses 20 employees in one year due to uninspiring leadership and poor advancement opportunities.

5 frontline/entry level employees: Average salary: $50,000. (50,000 x 5 x 100%) = 125,000

5 middle managers: Average salary: $80,000 (80,000 x 5 x 100%) = 200,000

10 C-suite employees: Average salary: $110,000 (110,000 x 10 x 100%) = 550,000

Let’s go a bit deeper into the ROI of employee retention in retail. Say it costs Company X an average 50% of each lost employee’s salary to attract, screen and onboard their replacements. That means Company X would lose $875,000 in recruitment and retention costs within one year. As you can see, employee retention can quickly make or break a retail business. It’s critical to understand why employees leave their jobs and how to put measures in place to encourage employee loyalty.

Why do retail employees leave their jobs?

Top down management styles are going the way of the dodo. Every member of modern retail teams, particularly mid-level managers, expect to be consulted about the trajectory of the company. Employees in toxic or unfulfilling positions don’t always leave their jobs. But this isn’t always a positive for retailers’ bottom line. Let’s shed some light on the issue: More than 1 in 4 employees are “quiet quitting,” or doing only the bare minimum, while another 5% report doing “even less” than they’re paid to do at work.

Every employee has their own unique motivations and career priorities. A few different variable impact this, including: the level of employee –– frontline, floor manager, branch manager, C-suite, etc., employee age, and gender. “Inspiring leadership,” for instance, is fifth on the list of priorities for non managers, while it’s tied for seventh place among managers.

Rankings also vary by gender. Women are most likely to point to a “lack of inspiring leadership” as their reason for leaving their positions, whereas men usually point to “poor career development.” Of course, it could be argued that “inspiring leadership” and “career development opportunities” go hand in hand. Since “inspiring leadership” means the company is on a positive trajectory, or that employees trust in company leaders’ ability to successfully course correct.

Good news for your return on investment

Those that identify toxic traits within their organization and are struggling with employee turnover needn’t be discouraged. Employee culture is a pendulum and, like any other pendulum, you can swing right back into long term profitability. Frontline employees at the leading retailers are 2x as motivated in their day-to-day jobs and leave half as often. It is possible to create a culture that inspires employee loyalty but, most organizations require a healthy dash of humility from company leaders and a strong investment in management training.

Identifying unchecked toxic or uninspiring behavior within your organization is not a death sentence, it’s an opportunity. But changing employee perception requires top-down humility. Through the eradication of dated “my way or the highway” management styles, reprioritizing employee welfare, and putting management training systems in place at every level, even the most doomed organizations can course correct towards long term profitability.

How unified PIM & CRM help employee retention

The retail industry has appalling employee retention rates. However, most retail organizations only have customer relationship management software in place for the frontline of their organization, not for the employees themselves. As you’ve seen, putting measures in place to retain retail employees at all levels is critical to your organization’s bottom line.

An integrated CRM solution with collaboration management features that allow employees to collaborate with internal and external stakeholders can help: It can increase faith in management, reduce communication errors, and reduce tedious data re-entry. With the right integrated collaboration management solution, every employee hour on the clock will once again matter to your organization.

Share this

- PLM Software (36)

- PIM Software (29)

- Apparel & Fashion (20)

- Trending Topics (20)

- Merchandising (16)

- CRM Software (13)

- PLM Implementation (11)

- Catalog Management (6)

- Tech Packs (6)

- PLM RFP (5)

- Success Stories (5)

- Sustainability (5)

- Data Import (4)

- Line Sheet (4)

- Luxury Goods & Jewelry (4)

- Product Development (4)

- Retail (4)

- Supply Chain (4)

- Category Management (3)

- Home Furnishings (3)

- Wholesale (3)

- Consumer Packaged Goods (CPG) (2)

- Cosmetics (2)

- Data Export (2)

- Health & Beauty (2)

- RFQ & Quote Management (2)

- Consumer Electronics (1)

- Import & Export (1)

- Industry Events (1)

- Inventory Management (1)

- Pet Stores (1)

- Purchase Orders (1)

- Report Builder (1)

- Textiles & Raw Materials (1)

- Unified Solution (1)

- Vendor Management (1)

- Visual First (1)

- White Paper or Case Study (1)

- workflow (1)

- October 2025 (3)

- September 2025 (3)

- August 2025 (4)

- April 2025 (4)

- March 2025 (3)

- January 2025 (8)

- December 2024 (5)

- November 2024 (3)

- October 2024 (5)

- September 2024 (6)

- August 2024 (2)

- July 2024 (1)

- June 2024 (3)

- May 2024 (4)

- April 2024 (5)

- March 2024 (3)

- February 2024 (2)

- December 2023 (4)

- September 2023 (2)

- August 2023 (5)

- July 2023 (3)

- June 2023 (2)

- May 2023 (2)

- April 2023 (4)

- March 2023 (5)

- February 2023 (3)

- January 2023 (5)

- December 2022 (4)

- November 2022 (3)

- October 2022 (4)

- September 2022 (5)

- August 2022 (4)

- July 2022 (2)

- May 2022 (1)

- February 2022 (1)

- January 2022 (1)

- September 2021 (1)

- May 2021 (1)

- April 2021 (1)

- February 2021 (1)

- May 2020 (1)